Use it to plan your own robot barista payback period.

Want to know more details?

Please, contact your manager.

Aleksandr Maksimovich

Business Development Manager

Nalarobot Robotics | Nalarobot Café

Mobile: +375 333 760 460

(WhatsApp | Telegram | Viber)

BLOG

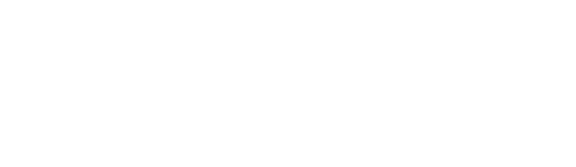

Challenges Faced by Global Buyers in Sourcing Robot Servo Motors

The increasing demand for automation across various industries has significantly boosted the market for Robot Servo Motors. According to a report by Grand View Research, the global servo motor market is expected to reach USD 7.56 billion by 2025, expanding at a compound annual growth rate (CAGR) of 7.6% during the forecast period. This growth is driven by the rising adoption of industrial robots in manufacturing and assembly processes, where precision and efficiency are paramount. As buyers from around the world seek high-quality Robot Servo Motors to meet their operational needs, they face a myriad of challenges that can complicate the sourcing process.

One of the primary challenges global buyers encounter is the complexity of the supply chain, which often involves multiple stakeholders and varying standards across countries. A report from Mordor Intelligence highlights that sourcing components globally can lead to significant delays and increased costs due to logistical issues and compliance with different regulatory environments. Furthermore, as technology evolves, buyers must navigate the rapid advancements in Robot Servo Motor specifications, ensuring compatibility with existing systems while also keeping pace with innovative features that enhance performance and efficiency. Addressing these challenges is crucial for buyers to secure reliable and cost-effective solutions in the ever-competitive landscape of robotics.

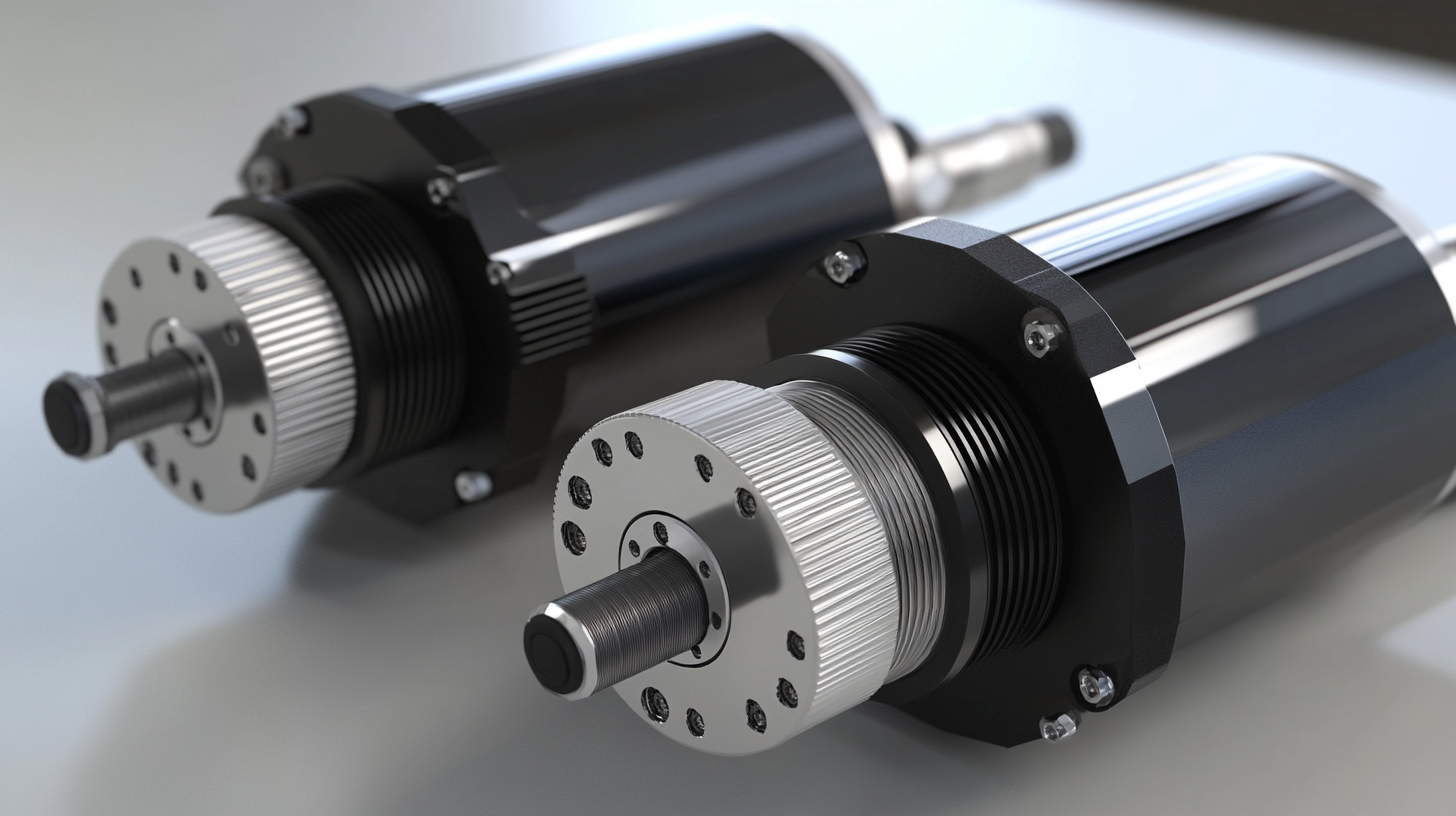

Challenges in Assessing Quality Standards for Robot Servo Motors in Global Markets

The global market for robot servo motors is expanding rapidly, driven by advancements in automation and robotics. However, despite this growth, buyers face significant challenges in assessing quality standards for these components across different regions. According to a recent report by MarketsandMarkets, the servo motor market is projected to reach USD 10.87 billion by 2025, highlighting the increasing demand and the critical need for reliable quality assurance. One of the primary challenges in evaluating the quality of robot servo motors is the variance in manufacturing standards between countries. For instance, while some regions adhere to stringent ISO certifications, others may not have comparable quality control measures in place. This discrepancy can lead to inconsistencies in product performance and reliability, making it difficult for global buyers to make informed sourcing decisions. A report by Frost & Sullivan states that approximately 30% of global buyers experience significant issues related to quality inconsistency, underscoring the importance of understanding local standards. Additionally, a lack of transparency in the supply chain complicates quality assessments. Many buyers depend on third-party suppliers for their servo motors, often without complete visibility into the production processes or the materials used. A study by IDC revealed that 40% of manufacturers cite supply chain disruptions as a major concern, further exacerbating the difficulties in ensuring product quality. As global buyers navigate this complex landscape, they must not only evaluate the specifications of servo motors but also consider the rigorousness of the quality standards implemented by their suppliers.

Impact of Supply Chain Disruptions on Robot Servo Motor Availability and Pricing

The global market for robot servo motors is currently facing significant challenges, primarily driven by supply chain disruptions that have impacted availability and pricing. Recent reports indicate that prices for key materials, such as neodymium iron boron, have surged to their highest levels in over a year following the Chinese New Year, creating an additional strain on manufacturers who rely on these resources for producing humanoid robots. The volatility in material costs not only raises the expense of production but also complicates the planning and budgeting processes for global buyers.

Amidst these challenges, companies like YJD Technology are striving to reshape the landscape by introducing competitively priced humanoid robots, such as the Dobot Atom. Priced starting at 199,000 yuan, this innovative robot is set to capture attention and could potentially shift the balance of the market. As the focus of robotic development moves towards mass production, the competitive pricing against rising materials costs will be a critical factor. In the long run, the adaptation to these supply chain disruptions will determine the viability of many global buyers in acquiring the necessary components for advanced robotic applications.

The effects of continuous supply chain disruptions are evident, with manufacturers now grappling with the prospect of not only higher prices but also uncertainty. Investing in diversified supply chains or securing long-term contracts may be essential strategies for biotechnology and robotics firms to stabilize their operations and maintain profitability. As advancements in technology accelerate, navigating these challenges will be crucial for any global buyer looking to sustain their competitive edge in the rapidly evolving field of robotics.

Navigating Diverse Regulatory Compliance Requirements Across Different Regions

In the rapidly evolving landscape of robotics, global buyers face significant challenges when sourcing servo motors, particularly due to the diverse regulatory compliance requirements that vary across regions. According to a report by MarketsandMarkets, the global servo motors market is projected to grow from $7.4 billion in 2020 to $11.0 billion by 2025, fueled by advancements in automation and robotics. However, navigating the complexities of international regulations adds a layer of difficulty for buyers seeking to optimize their supply chains.

Each region has its own set of compliance standards which can affect quality assurance, safety protocols, and environmental regulations. For instance, the European Union's directives on machinery and electromagnetic compatibility impose stringent requirements on manufacturers, leading to longer lead times for compliance verification. A study by TÜV Rheinland highlights that 40% of global manufacturers have reported disruptions due to non-compliance with local regulations. This illustrates the importance for buyers to conduct thorough research and engage with local experts who understand the nuances of regional guidelines.

Moreover, trade agreements and tariffs can further complicate sourcing decisions. The United States-Mexico-Canada Agreement (USMCA) introduces specific requirements for components used in automation systems, which can change the cost structure for buyers sourcing from these countries. Understanding these shifting landscapes can empower companies to mitigate risks, build stronger supply chains, and enhance their competitive edge in the global market. As the robotics industry continues to grow, the ability to effectively navigate these regulatory challenges will be crucial for global buyers aiming to leverage innovative technologies in their operations.

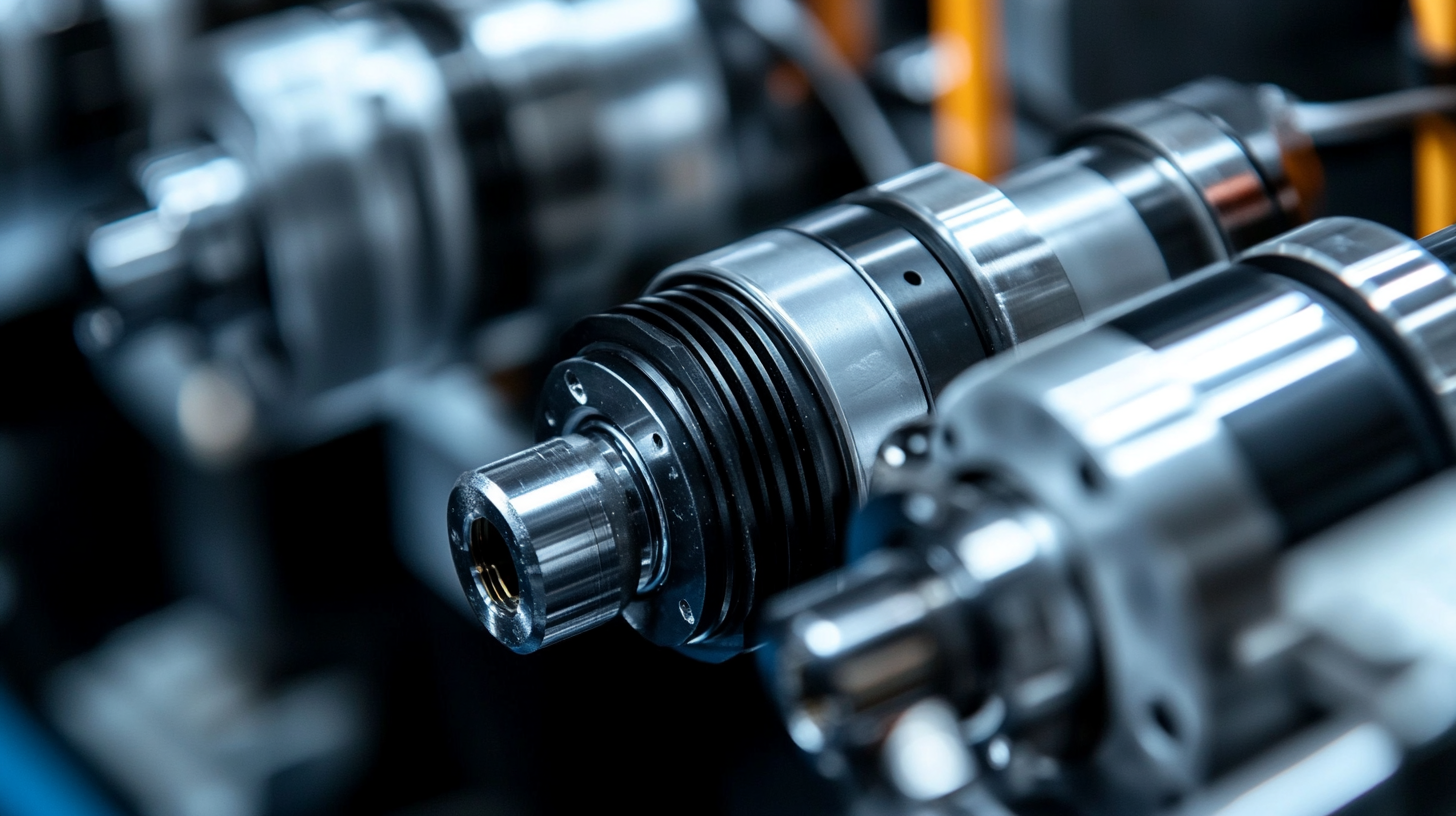

The Role of Technological Advancements in Evolving Buyer Requirements for Servo Motors

The evolving landscape of servo motor procurement for global buyers is significantly shaped by technological advancements, particularly within industries like robotics and automation. As the demand for high-precision components rises, buyers are grappling with the challenge of sourcing servo motors that meet increasingly sophisticated requirements. This is particularly evident in sectors such as surgical robotics, where the integration of multiple disciplines—including biomechanics and computer science—demands servo motors that not only provide reliability but also enhance surgical precision.

Furthermore, as highlighted in recent industry reports, the industrial robotics sector is witnessing rapid transformation driven by advancements in automation technologies. Global buyers are not just looking for standard solutions; they crave innovative designs that can cope with the complexities of modern applications, especially in medicine and manufacturing. This indicates a shift in buyer expectations, where technological sophistication is paramount.

Consequently, the challenge for buyers is to keep abreast of these advancements while ensuring they procure servo motors that align with their operational goals. Navigating this evolving environment requires strategic partnerships with suppliers who can provide insight into the latest technologies and help buyers understand how to leverage these advancements effectively. As the landscape continues to change, the focus will remain on agility and adaptability in sourcing efforts.

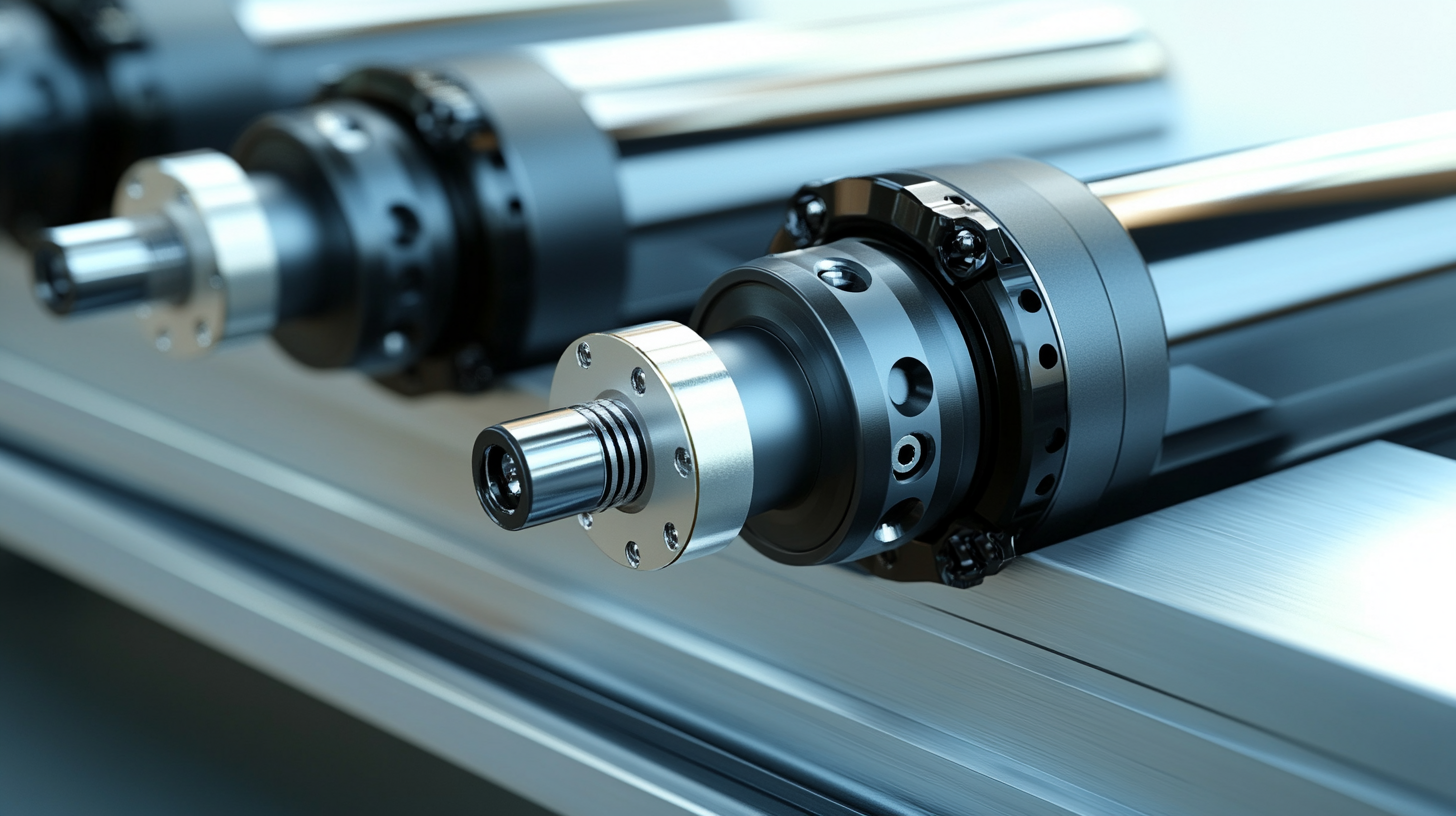

Understanding the Competitive Landscape: Key Players and Market Shares in Servo Motor Sourcing

In the rapidly evolving market for robot servo motors, global buyers face significant challenges while navigating the competitive landscape. According to a recent industry report, the global servo motor market is projected to reach approximately $8 billion by 2026, growing at a CAGR of around 6.8% from 2021. This growth is driven by the increasing demand for automation across various sectors including manufacturing, aerospace, and robotics. However, the competitive environment is intensifying, with key players such as Siemens, Mitsubishi Electric, and Yaskawa Electric vying for market dominance.

Understanding market shares is crucial for buyers seeking to optimize their sourcing strategies. For instance, Siemens currently holds a leading market share of around 22%, attributed to its robust product offerings and strong customer relationships. Meanwhile, Mitsubishi Electric follows with approximately 17% of the market, leveraging its innovative technology to capture a significant portion of the buyer's interest. This competitive dynamic emphasizes the need for buyers to strategically evaluate their suppliers based on both technology and service capabilities.

Additionally, buyers must contend with regional disparities in market presence. North America and Asia-Pacific are the largest markets for servo motors, collectively accounting for over 60% of total market share. However, emerging regions are progressively gaining traction, necessitating a nuanced approach to sourcing and assessing suppliers' capabilities. Furthermore, sustainability and energy efficiency are becoming critical factors as buyers seek to align with global standards and customer expectations, making it essential for suppliers to innovate continuously in their product development.